第一回 Bitcoinをはじめてみました No.1 の続きです。

7. an exchange is not a wallet

In order to trade bitcoin, you must deposit Japanese yen or bitcoin at the exchange you choose.

If it’s your first time, you naturally don’t have bitcoins, so you will have to deposit Japanese yen. At this time, you will need to pass the personal authentication process conducted by each exchange. For overseas exchanges, but not for Japanese exchanges, if you upload a photo of your driver’s license or passport, you should be able to clear the personal verification without any problems. It depends on the exchange, but it took me at least a day to finish.

ここで大事なのは、取引所とウォレットは違う概念だということです。

It is true that when you trade on an exchange, you need to deposit Japanese yen or bitcoin to the exchange. In that sense, it seems to be similar to a wallet.

当然ながら取引所に預けた資産は自分自身のものですが、この資産がさらされるリスクのうち、取引所自体がサイバー攻撃を受ける、破綻してしまう、もしくは不正利用されることによって、自分自身の資産が毀損あるいは喪失してしまうリスクは、自分自身ではコントロールすることができません。このリスクは取引所しか管理を任せる以外ありません。

At best, we can only control the choice of exchange and the ID and password to access each exchange.

ということで、基本的に多くの取引所では、各人が独自のウォレットを必ず持つように推奨しています。通貨やビットコインを必要以上に置きっぱなしにせず、適宜ウォレットへと移管するように促しています。

In order to properly understand the Mt. Gox case, it is necessary to understand the nature and background of these events. Gox was a case where bitcoins were illegally withdrawn from an exchange, not a case where the bitcoin system itself was hacked or collapsed. Perhaps it’s because of the media coverage in Japan, but I feel that many people misunderstand this point. To be honest, I didn’t understand this incident correctly until I studied it this time.

要するに、ビットコイン取引参加者が、取引所への預けておく資産と自身のウォレットへ置いておく資産の管理を適切にしておけば、たとえ取引所が破綻したとしても、被害を最小限に食い止めることができるわけです。だからこそ、必ず各人がウォレットを自分自身で責任持って管理することが大事、他人を完全に信用してはいけないということです。

Of course, each person’s wallet can be subject to cyber attacks. However, this is something that can be managed within one’s own scope and is completely one’s own responsibility. Therefore, even if you were to lose your Bitcoins in a cyber-attack, no one would be able to attack you, which would make much more sense than losing your assets due to an exchange failure.

Other risks will be discussed again below.

8. many exchanges provide a wallet, but I decided not to use it

In conclusion, as I explained above, “the principle of asset protection is self-responsibility”, and in light of this, I decided not to use the wallet function of many so-called exchange-like services. I decided to do everything at my own risk, including transactions. In addition, the high fees and the fact that the exchange price deviates from the market price and I cannot decide at my own discretion were also major reasons for not using them.

By the way, it seems that there is also a bitcoin ATM. It is tempting to try them out, but at best you can only check how expensive they are.

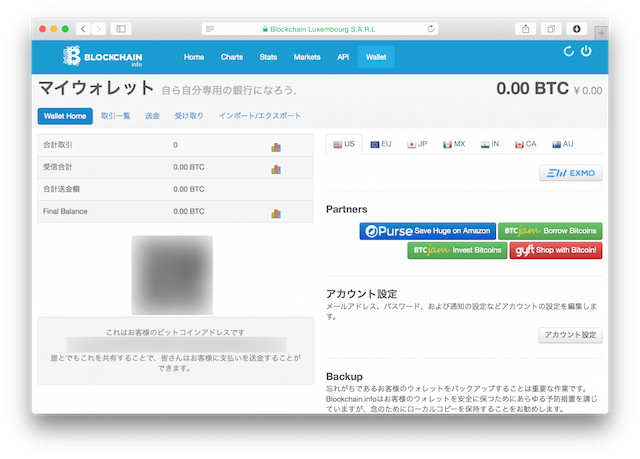

9. I created a wallet.

Now that I’ve done enough preliminary research, I’d like to move on to the action. The first step is to create a wallet.

私は、当初自分の端末にソフトウェアをインストールすることも検討したのですが、最終的には、比較的導入が簡単で使いやすそうなBlockchain.infoを選択しました。

Blockchain.info | https://blockchain.info/ja/

Although there are many security threats, I chose this because it is one of the most trusted web wallets with many users worldwide.

Maybe it’s not a good idea to disclose “what you’re using”, but for now I don’t mind since I think I’ll still only be doing small transactions.

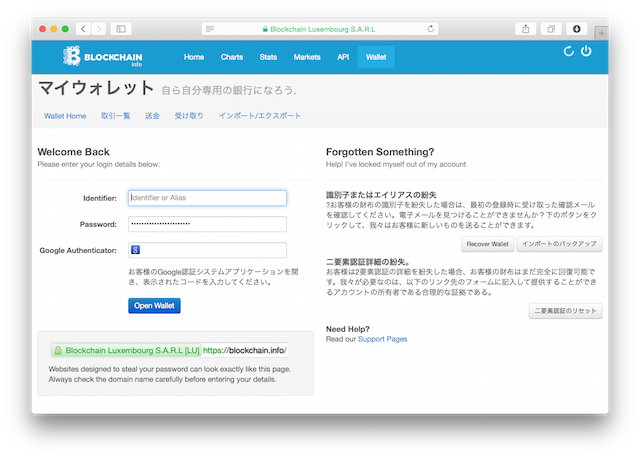

そうはいっても、このウェブウォレット、物凄いセキュリティー管理だと思います。パスワードはかなり長くしないと”very strong”って言われませんし(私は20数文字にしました)、2段階認証にも対応しております。Google Authenticator対応はとてもありがたいところ。従って私が自分の端末にソフトウェアをインストールして管理するよりずっと安心のような気もします。

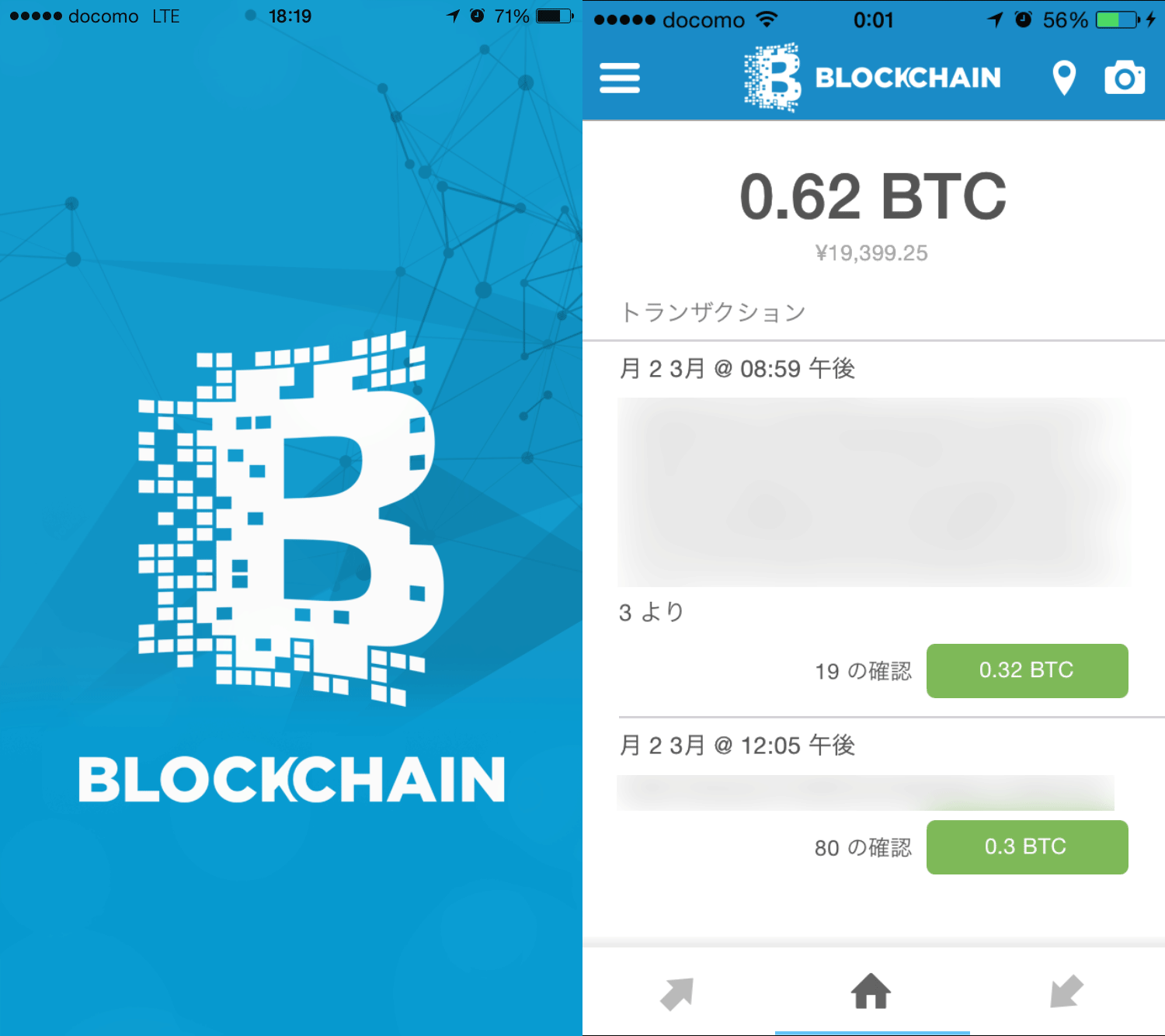

By the way, this Blockchain.info web wallet is also available for iOS and Andoroid. This is a security concern, but this is what makes it so easy to use when traveling.

It is unknown how bitcoin will develop in the future and be able to use it in the travel, but this web wallet of Blockchain.info will be able to use it like a kind of prepaid credit card by using this iOS application, so it may be convenient to save a small balance for travel. It may be convenient to save a small balance for travel.

I think the choice of Blockchain.info in the form of a web wallet was the right one, even based on the use in the travel destination as per such original purpose.

10. I’ve chosen an exchange.

What was important to me in choosing an exchange was

- 日本円対応が容易であること

- 取引量がそれなりにあること

- 手数料が安いこと

“1. Japanese yen support” is essential for Japanese residents. “If the transaction volume is low, there is a high possibility that the transaction will not be completed, so you will not be able to buy and sell bitcoins as expected. “This is the simplest but most important reason.

What specific exchanges did you consider, and I decided to consider three types

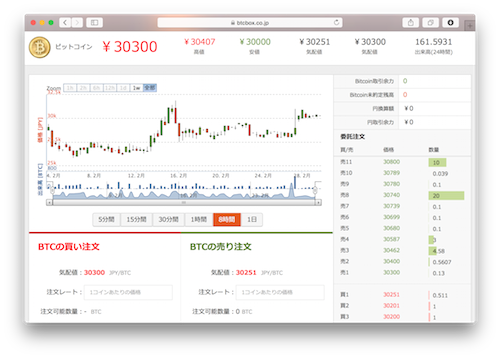

「BTCBox」

First of all, BTCBox is said to have the largest trading volume in Japan, and it seems to be an exchange that was set up about a week after the collapse of Mt.

BTCbox | https://www.btcbox.co.jp/

Among the exchanges that support the Japanese yen, the trading volume is also high. However, there is a 0.2% commission for both buying and selling, which is a concern.

二段階認証対応。Google Authenticatorが使えます。

「coincheck」

The next one I considered was coincheck, which seems to be a relatively new exchange.

coincheck | https://coincheck.jp/

This is the easiest authentication process because you can authenticate with Facebook. And for now, the 0% commission may be quite reasonable due to the campaign.

It seems that it will increase in the future… At the moment, the trading volume is a little lower than BTCBox due to its newness, but I think there is a great possibility that it will grow in the future due to its simple UI and ease of authentication. I have high expectations for it.

二段階認証対応。Google Authenticatorが使えます。

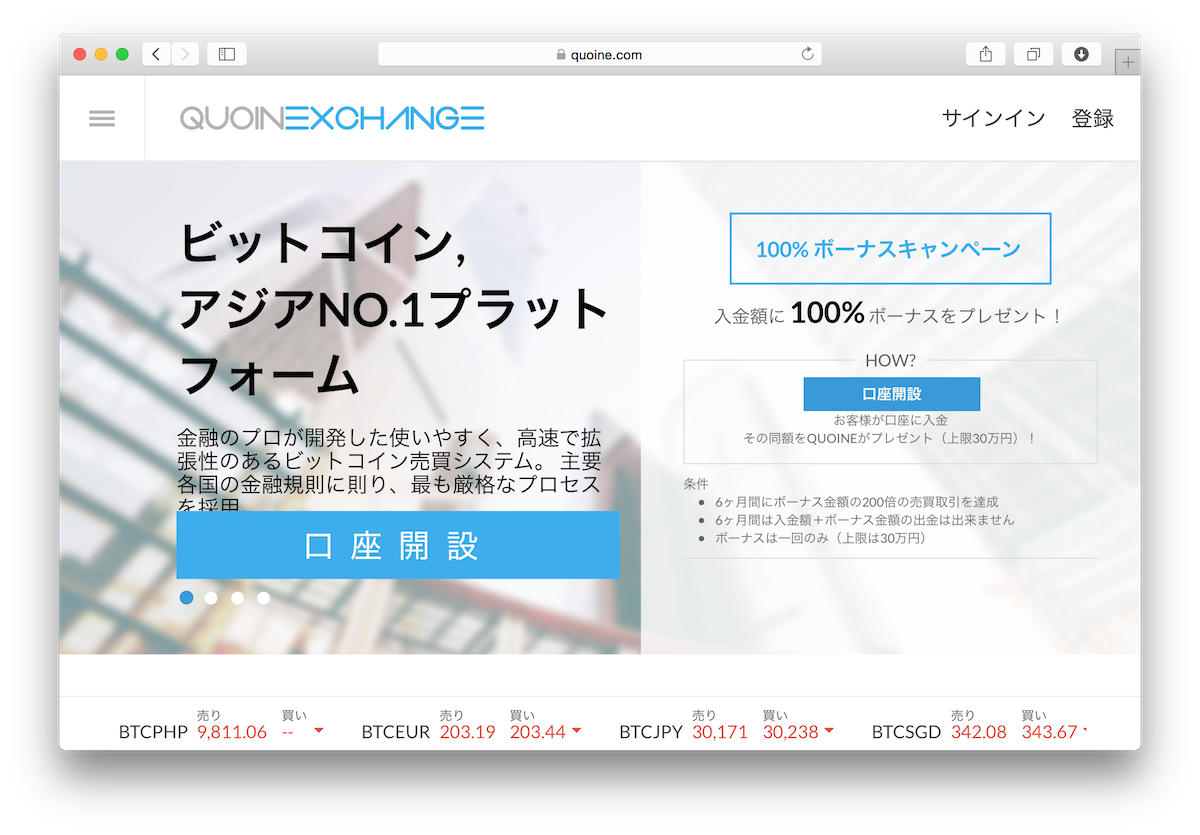

「Quoine」

The last one is Quoine Exchange, a Singapore-incorporated exchange with a focus on Asia.

Quoine exchange | https://www.quoine.com/

It features a very sophisticated UI. Many of the company’s members are also experienced in foreign finance and other fields.

The feature is that the commission is 0.5% if it is a market order, but 0% if it is a limit order. If you buy and sell at the limit price carefully, this is probably the most profitable. Also, from a quick look at the board information, I had the impression that the bitask spread was smaller than the above two exchanges.

However, the trading volume of BTCJPY seems to be still small. The place where the volume is not disclosed like the above-mentioned two exchanges is also anxious.

By the way, there is two-step verification here, but it is handled by SMS.

For now, I’ve decided to start trading bitcoin with coincheck and Quoine for starters, with fees being the most important factor.

次回は、第三回 Bitcoinはじめてみました No.3