めずらしく一見真面目な話題など。(でも実は、内容は結構てきとーで全然難しくなかったりします。)

- Feeling neglected? Defined contribution pension plans

- How should I manage it – is the neck the asset allocation?

- Our GPIF!

- GPIF’s Basic Portfolio

- The basic portfolio is determined by some big-shot academic or professional who’s doing their best to get it right!

- GPIF’s investment performance is boring, but not that bad.

- Once you’ve decided on the asset allocation, the rest is not so difficult.

- Conclusion: let’s imitate the GPIF for now

- Plus: For those who are not satisfied with the GPIF allocation – CalPERS asset allocation

Feeling neglected? Defined contribution pension plans

Defined contribution pension plans are now being adopted by a significant number of companies.

There are probably many people who have heard the word, but I wonder how many of them actually understand what kind of system it is and actually check it in detail.

Of course, there are some people who check the details and change the investment ratio (contribution ratio), but I imagine that most people tend to neglect it.

一応おさらいしておきますと、確定拠出年金(wikipedia)とは、「年金資産を加入者が自分で運用し、その結果の損益に応じて年金額が決定される」年金です。

つまり、国任せ会社任せであるいわゆる確定給付年金(wikipedia)ではなくて、自分で運用して自分で責任もつって感じの年金なわけです。

How should I manage it – is the neck the asset allocation?

I think most people understand this level of knowledge, but the question is how to operate it, right?

The same is true for the selection of investment products, but perhaps the biggest obstacle is the asset allocation.

That’s right. It’s about what assets to buy and how much to buy them, but don’t you think it’s hard to know how to decide this policy?

In fact, I feel that this is a barrier and many people don’t know what to do with it and end up leaving it unattended.

Our GPIF!

Now, I’d like to introduce an organization called GPIF. I think it sometimes appears in newspapers, but do you know about it?

The official name of the GPIF is as follows.

Independent Administrative Institution for Pension Fund Management

(Government Pension Investment Fund / The Pension Welfare Service Public Corporation)

ご参考:Wikipedia

GPIFについて知る | 年金積立金管理運用独立行政法人 http://www.gpif.go.jp/gpif/index.html

ざっくりいうと「公的年金」というものです。

It is a collection of pension-related payment amounts that are somehow deducted together from the salaries that everyone pays. At any rate, you should think that there is such a lump of money.

ちなみにGPIFの規模なのですが、平成22年度末時点で「116兆円!」

前年度末の運用状況ハイライト | 年金積立金管理運用独立行政法人 http://www.gpif.go.jp/operation/archive.htmlより

Ummm, it’s huge…. The loss of 300 billion yen in the last fiscal year is also a big deal…

GPIF’s Basic Portfolio

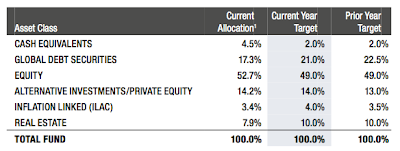

GPIFは、いわゆる年金基金の資産配分=基本ポートフォリオを公表しています。これがとっても参考になるわけです。

The current allocation is as shown.

基本ポートフォリオ | 年金積立金管理運用独立行政法人 http://www.gpif.go.jp/gpif/portfolio.html

As a matter of fact, Japanese corporate pension funds use the asset allocation (sometimes called asset allocation) of this fund as a reference. After all, it is not only the largest in Japan but also one of the largest in the world. Its influence is huge.

そもそも公的年金って私達国民の資産、その配分がどうなっているのかを知っておくことは大事なこととも言えます。

The basic portfolio is determined by some big-shot academic or professional who’s doing their best to get it right!

Now, the question that concerns me very much is.

「いったいどういった基準で、どういった方法でこうした配分が決まっているのか」

I think that’s what it means.

It is true that the GPIF is entrusted with the people’s precious pensions, so of course they have a duty to explain to the people why they have chosen this basic portfolio.

ということで、GPIF’s Basic Portfolioは、その業界を代表するお偉い学者さんとかプロの面々が幾度と無く議論を重ねて決めているわけです。素晴らしい!頼もしいぞ!

However, strictly speaking, this kind of asset allocation problem doesn’t have a theory or evidence that everyone can agree on properly.

In the first place, asset management is never guaranteed to be based on current views and predictions in the future, so there is a limit to the number of so-called « models » and « theories » that can be used.

Since it is such a world, even if we amateurs think deeply about it, it will not have much effect.

ということで、とってもお偉い方たちがきちんとその資産配分について議論してくださっているのですから、あまり深く考えないで素直にその結果に便乗するのは悪くはないと思います。

GPIF’s investment performance is boring, but not that bad.

Incidentally, how well has the GPIF performed?

前年度末の運用状況ハイライト | 年金積立金管理運用独立行政法人 http://www.gpif.go.jp/operation/archive.html

通期でだいたい11%、年率1.2%なんだから微妙っちゃ微妙だけど、このご時世にしては上等なのではないでしょうか。よくわかってない個人が下手に外国資産ものや新興国ものに投資して円高で大ヤラレするより全然ましですよ(笑)

Once you’ve decided on the asset allocation, the rest is not so difficult.

The next thing we need to think about is how we are going to structure this asset allocation. In other words, what kind of mutual funds should we buy?

Actually, this is easier than you might think.

というのは、資産運用って「資産配分でほぼ決まる」といっても過言ではないんです。従って、具体的にどんな銘柄(投信)に投資して決めた資産配分を実現していくのかというところに時間を割いても実は全然報われないことが多い。

であれば、どうせ頑張ってもだいたい無駄に終わる銘柄選択など余計なところに時間をかけないのは、ひとつの賢い選択といえます。

I think it’s enough to decide on a product that belongs to the genre of domestic stocks that are lined up for the DC pension plan by using Amidakuji or something like that.

… Well, it’s too unkind to say so, so why don’t you refer to this book for example?

ほったらかし投資術 インデックス運用実践ガイド (朝日新書)

It may sound persistent, but of course it is up to the individual to take the time to carefully examine the type of investment trust he or she chooses.

Conclusion: let’s imitate the GPIF for now

Therefore, when selecting investment products for your defined contribution pension plan, I recommend that you match your asset allocation to the GPIF’s basic portfolio so that you don’t have to worry about it.

(再掲)GPIF’s Basic Portfolio

As for specific investment issues (investment trusts), it is recommended to choose the products lined up in the genre above without thinking about this and that. (I recommend the index fund from the most cost perspective)

Plus: For those who are not satisfied with the GPIF allocation – CalPERS asset allocation

こんな保守的な運用じゃつまんないよーって方にオススメなのはカルパース(CalPERS)のアセットアロケーション!

From Annual Investment & Financial Reports http://www.calpers.ca.gov/index.jsp?bc=/investments/reports/home.xml

Compared to the GPIF, the ratio of stocks is much higher. In other words, we are taking a lot of risk.

And here’s what the yearly rate of return looks like

From Annual Investment & Financial Reports http://www.calpers.ca.gov/index.jsp?bc=/investments/reports/home.xml

Yeah, that’s aggressive!

But if you think that’s a little too extreme, you could add the GPIF and CalPERS allocations together and divide by two.

It’s in English and there are a lot of terms I don’t understand, but it’s called one of the most advanced pension funds in the world, so if you refer to the asset allocation here, you too could become an advanced defined contribution pension plan manager!

ご参考:CalPERS Investments http://www.calpers.ca.gov/index.jsp?bc=/investments/home.xml

If you are interested, why don’t you study it?

ご留意事項

The purpose of the said article is to provide information for reference in making investment decisions. In addition, future projections do not guarantee the results. The final decision to actually invest should be made by your own judgment.